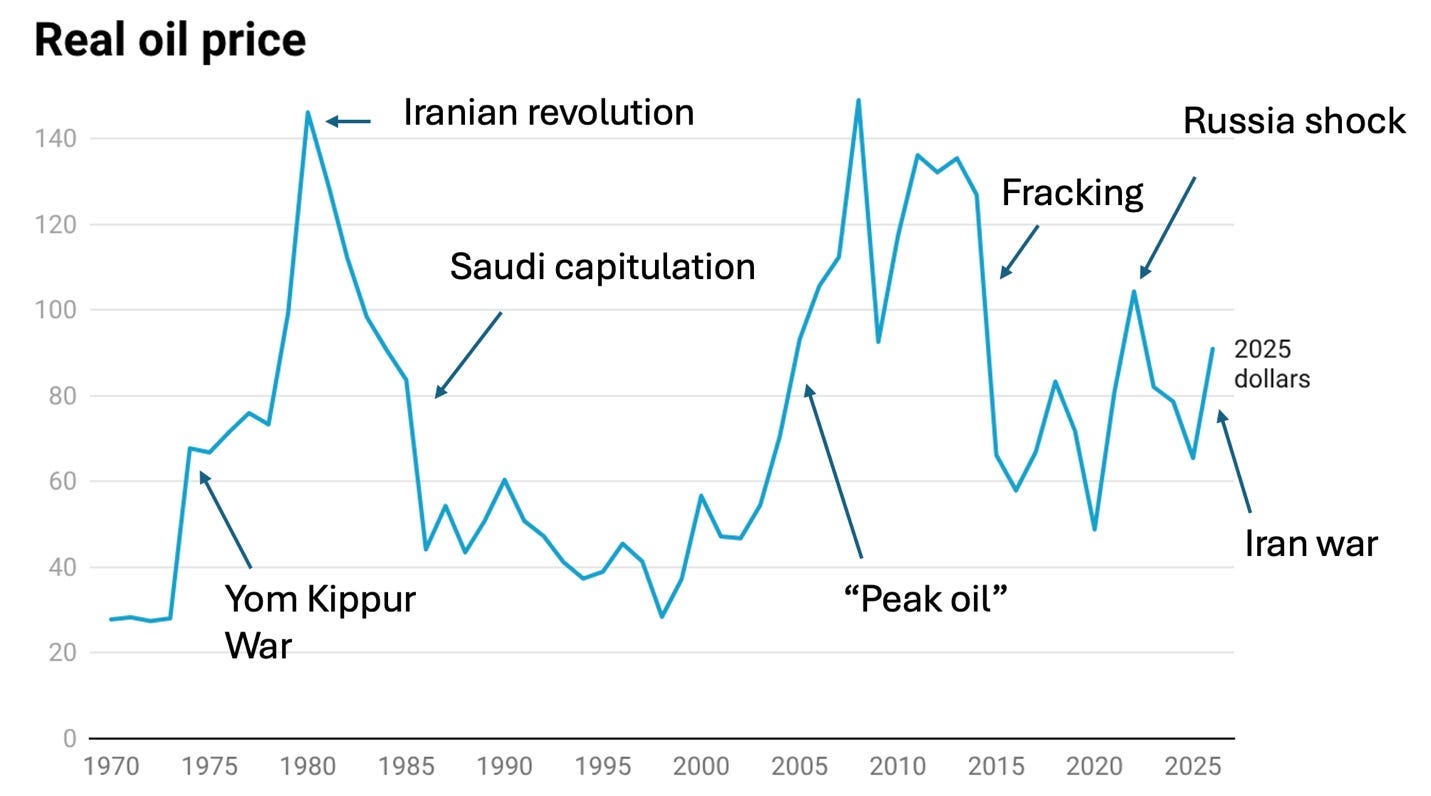

At 8:50 yesterday morning, President Donald J. Trump posted on social media: “There will be no deal with Iran except UNCONDITIONAL SURRENDER! After that, and the selection of a GREAT & ACCEPTABLE Leader(s), we, and many of our wonderful and very brave allies and partners, will work tirelessly to bring Iran back from the brink of destruction, making it economically bigger, better, and stronger than ever before. IRAN WILL HAVE A GREAT FUTURE. ‘MAKE IRAN GREAT AGAIN (MIGA!).’ Thank you for your attention to this matter! President DONALD J. TRUMP”

As Alex Leary and Vera Bergengruen of the Wall Street Journal observed, the demand for unconditional surrender was quite a shift from Trump’s original promise to the people of Iran that the future is “yours to take,” or even his early claim that he was hoping to knock out Iran’s nuclear facilities. Trump’s shift highlighted that there appears to have been very little planning for what would happen after U.S. and Israeli bombs began to rain on Iran.

Leary and Bergengruen noted that Trump was bouncing ideas for the next stage of the assault off journalists even as ships stopped passing through the Strait of Hormuz, American citizens were stranded in the Middle East, the war spread to countries throughout the region, and U.S. military personnel died.

When reporters asked about what Trump meant by unconditional surrender, White House press secretary Karoline Leavitt seemed to say that unconditional surrender meant whatever Trump decides it does whenever he decides what the goals of Operation Epic Fury are. She said: “What the president means is that when he as commander in chief of the U.S. armed forces determines that Iran no longer poses a threat to the United States of America and the goals of Operation Epic Fury has [sic] been fully realized, then Iran will essentially be in a place of unconditional surrender whether they say it themselves or not.”

Like other administration figures, Leavitt suggested that the violence itself was the point, saying: “Frankly, they don’t have a lot of people to say that for them because the United States and the state of Israel have completely wiped out more than fifty leaders of the former terrorist regime including the supreme leader himself.”

President of Iran Masoud Pezeshkian said Iran’s enemies “must take their dream of the Iranian people’s unconditional surrender to their graves,” but he did apologize to neighboring countries for the strikes against U.S. military bases in their lands. He said Iran would suspend those strikes unless those states themselves launched attacks on Iran.

At 6:11 this morning, Trump posted on social media: “Iran, which is being beat to Hell, has apologized and surrendered to its Middle East neighbors, and promised that it will not shoot at them anymore. This promise was only made because of the relentless U.S. and Israeli attack. They were looking to take over and rule the Middle East. It is the first time that Iran has ever lost, in thousands of years, to surrounding Middle Eastern Countries. They have said, ‘Thank you President Trump.’ I have said, ‘You’re welcome!’ Iran is no longer the ‘Bully of the Middle East,’ they are, instead, ‘THE LOSER OF THE MIDDLE EAST,’ and will be for many decades until they surrender or, more likely, completely collapse! Today Iran will be hit very hard! Under serious consideration for complete destruction and certain death, because of Iran’s bad behavior, are areas and groups of people that were not considered for targeting up until this moment in time. Thank you for your attention to this matter! President DONALD J. TRUMP”

Zach Everson of Public Citizen recalled a quotation from William Shirer’s The Rise and Fall of the Third Reich, summing up Adolf Hitler’s view: “We must always demand so much that we can never be satisfied.”

Today, on Air Force One, when asked “what unconditional surrender looks like to you,” Trump answered: “Where they cry uncle or when they can’t fight any longer and there’s nobody around to cry uncle. That could happen too…. If they surrender or if there is nobody around to surrender but they’re rendered useless in terms of military.”

On Thursday, Defense Secretary Pete Hegseth warned representatives from sixteen Latin American and Caribbean countries that if they don’t adopt more aggressive strategies against drug cartels, the Trump administration will do it for them. Hegseth urged the countries to remain “Christian nations, under God, proud of our shared heritage with strong borders,” and not be led astray by “radical narco-communism, anarcho-tyranny…and uncontrolled mass migration.”

Tiago Rogero of The Guardian reported that Latin American countries resisted the framing of Hegseth’s speech. The title of his article used the word “dismay.”

In Miami today, Trump and his advisors convened a “Shield of the Americas” summit with twelve of Latin America’s Trump-aligned leaders. At the meeting, Trump called for an “anti-cartel coalition” that would use military might to crush drug cartels. Former homeland security secretary Kristi Noem told the group: “Now that America is secure, and our borders are secure, we want to focus on our neighbors and help our neighbors with their borders and the challenges they have.”

Trump suggested that Cuba was next on his list of countries to topple. “We’re looking forward to the great change that will soon be coming to Cuba,” Trump said. “They have no money, they have no oil, they have a bad philosophy and bad regime.” “Cuba is in its last moments of life as it was, but it will have a great new life,” he said.

In Need to Know, David Rothkopf today called out the madness of the fact world trade and global security is being shattered by a single man. “Not since Adolf Hitler blew his brains out in a bunker beneath the garden of the German Reich Chancellery on April 30, 1945, have the lives of so many people around the world been so buffeted by the psychosis of a single man.”

Why has Trump launched a war against Iran on a whim, attacked other countries, and upended world trade, Rothkopf asked. “Because he’s insane. Because he’s venal. Because he’s a malignant narcissist. Because he’s a sociopath. Because he has a fragile ego. Because those around him exacerbate and play to those traits to advance their own interests. Because CEOs and investors do likewise to fill their coffers. Because to some people, whether he is insane or malevolent or repugnant or not matters less than whether his actions will feather their nests, increase their power.

“Because they, the billionaires…play their games and the consequences for the little people down below, the consequences for us, hardly matter a whit.”

On Thursday, Senator Sheldon Whitehouse (D-RI) called attention to another factor in play. In a speech to the Senate, Whitehouse noted that throughout his second term, Trump has advanced policies that help Russia, pausing weapons shipments to Ukraine, easing sanctions on Russia, and pushing a peace deal favorable to Russia. Last summer, he welcomed Putin to American soil, and administration officials have parroted Russian propaganda. Russian state media gloated when Trump “installed Russia apologist Tulsi Gabbard as his director of national intelligence,” and Attorney General Pam Bondi upon taking office stopped the anti-kleptocracy work that had targeted Russian oligarchs.

Trump’s new national security policy threw traditional U.S. allies overboard and favored policies that Russian government officials praised as “largely consistent” with their own.

“If Trump were purposefully doing Russia’s bidding,” Whitehouse said, “it is hard to see what he would be doing differently. The United States is the most powerful nation in the world. Russia is a weak, corrupt regime. My old friend Senator John McCain used to say that Russia is a gas station, run by gangsters, with an army. It doesn’t make sense that the President of the United States, who insists—insists—on being dominant in essentially every relationship, is so submissive to one person and that one person is Russia’s dictator, Vladimir Putin.”

Whitehouse suggested that the answer “could…have something to do with Trump’s close friendship with the deceased pedophile Jeffrey Epstein.” He noted that the Epstein files, riddled as they are with references to Trump, are also riddled with references to Russian girls and women, Russian operatives, and Russian president Vladimir Putin.

Whitehouse spoke about how many of Epstein’s victims believed he was recording them, and how there were hidden cameras installed throughout his homes. He quoted Epstein victim Virginia Giuffre, who wrote: “He explicitly talked about using me and what I’d been forced to do with certain men as a form of blackmail, so these men would owe him favors.”

Whitehouse suggested the possibility that Epstein might have been working with Russian operatives, but emphasized that we don’t know. “Epstein was an inveterate liar and a criminal who often sought to exaggerate his power and influence, and the Epstein files need to be viewed through that lens,” he said. “What we do know is that a significant number of powerful men—our current President, some of his cabinet secretaries, tech billionaires like Elon Musk, Bill Gates, and others—were very mixed up with Epstein at different times. And Epstein seems to have been very mixed up with Russia.”

“We also know that there is a cover-up afoot at the Department of Justice,” he continued, where officials are “trying to shield Trump from something in the Epstein files.”

“One of the great forces that Washington runs on is normalcy bias,” he said, but he suggested looking past that bias to note that “we have links with Russia, girls from Russia, money from Russia, people from Russia, deals and transactions with Russia, contacts with people with Russian intelligence, news reports exploring contacts with Russia, and an official investigation from the government of Poland into an Epstein-Russia connection.”

Yesterday Noah Robertson, Ellen Nakashima, and Warren P. Strobel of the Washington Post reported that Russia is providing Iran with the information it needs to attack U.S. forces in the Middle East, including aircraft and ships.

During a roundtable on college sports, Peter Doocy of the Fox News Channel asked Trump about that report, saying: “It sounds like the Russians are helping Iran target and attack Americans now.” Trump responded: “I have a lot of respect for you. You’ve always been very nice to me. What a stupid question that is to be asking at this time. We’re talking about something else.”

—

Notes:

https://www.wsj.com/world/middle-east/trump-is-rewriting-the-iran-endgame-in-real-time-98f8531f

https://www.theguardian.com/world/2026/mar/07/iran-trump-unconditional-surrender-war-masoud-pezeshkian

https://www.theguardian.com/world/2026/mar/07/an-ideological-guest-list-trump-invites-latin-americas-rightwing-leaders-to-florida-summit

https://www.theguardian.com/us-news/2026/mar/07/trump-shield-of-americas-summit

https://www.theguardian.com/world/2026/mar/07/an-ideological-guest-list-trump-invites-latin-americas-rightwing-leaders-to-florida-summit

https://www.theguardian.com/us-news/2026/mar/05/hegseth-latin-america-drug-cartels

https://abcnews.com/Politics/trump-speak-shield-americas-summit-aimed-taking-cartels/story?id=130847707

https://www.washingtonpost.com/national-security/2026/03/06/russia-iran-intelligence-us-targets/

YouTube:

watch?v=ylvTFvJvB84

Bluesky:

zacheverson.com/post/3mghqh4cc4c2l

2026/03/06/trump-iran-oil-surrender.html

thetnholler.bsky.social/post/3mgj3lywzvc2h

atrupar.com/post/3mgfx6ep5ic2f

pauleric70.bsky.social/post/3mgghyqdcb22l

maxboot.bsky.social/post/3mgflyratnc25

Share